Wednesday, March 25, 2009

Total eyes Sabine Pass LNG date

Total eyes Sabine Pass LNG date

03-24-2009 - Upstream OnLine - French player Total expects to send its first cargo of liquefied natural gas to the Sabine Pass terminal in Louisiana from Nigeria in the middle of next month, according to reports. Philippe Sauquet, vice president for trading and marketing at Total Gas & Power told Reuters that Total is optimistic about Indian LNG demand this year and expects to see the Hazira terminal fully used for the first half of the year.

03-24-2009 - Upstream OnLine - French player Total expects to send its first cargo of liquefied natural gas to the Sabine Pass terminal in Louisiana from Nigeria in the middle of next month, according to reports. Philippe Sauquet, vice president for trading and marketing at Total Gas & Power told Reuters that Total is optimistic about Indian LNG demand this year and expects to see the Hazira terminal fully used for the first half of the year.

Tuesday, March 17, 2009

Shell investigated by SEC over bribery claims

Shell investigated by SEC over bribery claims

17 March 2009 - Times Online by Elizabeth Judge and Robin Pagnamenta - Shell is under investigation by authorities in the US for potential breaches of overseas bribery rules. The Anglo-Dutch oil giant revealed today that it is being probed by the Securities and Exchange Commission and the US Department of Justice for alleged violations of the US Foreign Corrupt Practices Act. The probe relates to alleged payments made on its behalf by a company called Panalpina to customs officials in Nigeria. Shell said it is co-operating with the US authorities and also conducting its own internal investigation. A spokesman for the group said it had first notified investors about the case in 2007. The revelation came as Shell confirmed a 5 per cent dividend increase and pledged to invest $32 billion in a string of oil and gas projects. In a statement, ahead of its annual briefing to investors, the group also said it was planning cost cuts. Jeroen van der Veer, the Anglo-Dutch group's chief executive, said the recession had "created opportunities for Shell to reduce supply-chain costs." Analysts say that staff cuts are likely. Plunging oil prices have led to a mounting sense of crisis in the industry, which has reacted by axeing projects and shedding thousands of employees. The problems resulted in BP last month reporting its first quarterly loss in more than seven years. The falling oil price has also fuelled concerns about the ability of oil companies to pay increased dividends while meeting their investment needs. But Shell, Europe's largest oil company, pledged to pay $10 billion in dividends this year — a 5 per cent increase in the first quarter of this year compared with a year ago. It would also invest $31-$32 billion in major projects around the world, it said. The group expects annual production growth of between 2 and 3 per cent in the next decade Its oil reserves remain unchanged from a year ago, making this the first year the group has not pumped more oil than it has added to its reserves since 2004. Mr van der Veer said: "These are testing times in the oil and gas industry. While short-term measures are important, we keep our long-term perspective and continue to believe that energy needs over the long term provide a positive context for Shell's investment programmes today." The group was planning "on the basis that the downturn could last more than a year," he said. Shell's crude output has been under pressure because about 20 per cent of its oil production is from Opec member countries, where quotas have been slashed by about 14 per cent. Shell's net reserves were 11.9 billion barrels of oil or equivalents at year-end — enough to last about ten years if it stopped developing projects. In January, Shell reported full-year 2008 earnings of $26.3 billion, down from $31.3 billion in 2007. Shares in Shell were down this morning 2.44 per cent, or 40p, to £16.

17 March 2009 - Times Online by Elizabeth Judge and Robin Pagnamenta - Shell is under investigation by authorities in the US for potential breaches of overseas bribery rules. The Anglo-Dutch oil giant revealed today that it is being probed by the Securities and Exchange Commission and the US Department of Justice for alleged violations of the US Foreign Corrupt Practices Act. The probe relates to alleged payments made on its behalf by a company called Panalpina to customs officials in Nigeria. Shell said it is co-operating with the US authorities and also conducting its own internal investigation. A spokesman for the group said it had first notified investors about the case in 2007. The revelation came as Shell confirmed a 5 per cent dividend increase and pledged to invest $32 billion in a string of oil and gas projects. In a statement, ahead of its annual briefing to investors, the group also said it was planning cost cuts. Jeroen van der Veer, the Anglo-Dutch group's chief executive, said the recession had "created opportunities for Shell to reduce supply-chain costs." Analysts say that staff cuts are likely. Plunging oil prices have led to a mounting sense of crisis in the industry, which has reacted by axeing projects and shedding thousands of employees. The problems resulted in BP last month reporting its first quarterly loss in more than seven years. The falling oil price has also fuelled concerns about the ability of oil companies to pay increased dividends while meeting their investment needs. But Shell, Europe's largest oil company, pledged to pay $10 billion in dividends this year — a 5 per cent increase in the first quarter of this year compared with a year ago. It would also invest $31-$32 billion in major projects around the world, it said. The group expects annual production growth of between 2 and 3 per cent in the next decade Its oil reserves remain unchanged from a year ago, making this the first year the group has not pumped more oil than it has added to its reserves since 2004. Mr van der Veer said: "These are testing times in the oil and gas industry. While short-term measures are important, we keep our long-term perspective and continue to believe that energy needs over the long term provide a positive context for Shell's investment programmes today." The group was planning "on the basis that the downturn could last more than a year," he said. Shell's crude output has been under pressure because about 20 per cent of its oil production is from Opec member countries, where quotas have been slashed by about 14 per cent. Shell's net reserves were 11.9 billion barrels of oil or equivalents at year-end — enough to last about ten years if it stopped developing projects. In January, Shell reported full-year 2008 earnings of $26.3 billion, down from $31.3 billion in 2007. Shares in Shell were down this morning 2.44 per cent, or 40p, to £16.

Friday, March 13, 2009

E.ON annual sales up 26%

E.ON annual sales up 26%

//Adjusted earnings before interest and taxes increase 7.3% to E9.9 billion

//Adjusted earnings before interest and taxes increase 7.3% to E9.9 billion03-12-2009 - Energy Business Review - German power and natural gas utility E.ON has reported sales of E86.8 billion for the year 2008, a 26% increase compared to the sales for the year 2007. The company has reported adjusted earnings before interest and taxes of E9.9 billion for the year 2008, a 7.3% increase compared to the same period of 2007. E.ON has invested E26.2 billion in 2008, more than twice as much as in 2007. The company has invested about E16 billion in the acquisition of operations under E.ON's agreement with Enel and Acciona and its agreement with Statkraft. E.ON had earlier announced €63 billion in investments for the period 2007-2010. By 2010, E.ON will have invested €60 billion of this figure. For the current planning period (2009-2011), the company’s earnings stability will enable it to largely continue its investment program. However, in view of the difficult economic environment, E.ON has again reviewed all projects in the current planning period and reduced the original figure by about €6 billion. After this reduction, E.ON will invest an average of €10 billion in each of the next three years (2009-11). About one third of investments will go towards updating and replacing networks and power plants in Germany and the United Kingdom. Two thirds are earmarked for growth. E.ON has hired 13,000 new employees group wide in 2008, approximately 5,000 of them in Germany. E.ON has 2,700 apprentices in Germany.

Oil Rich Nations Seek Majors Expertise

Oil Rich Nations Seek Majors Expertise

03-12-2009 - The Financial Times by Sheila McNulty – Dave O'Reilly, chief executive of Chevron, said the oil-rich countries that erected barriers to international oil companies amid the run-up in commodity prices were now seeking their expertise in managing the drastic fall. "They're back now looking for [our] investment,' Mr. O'Reilly told Chevron's annual analysts' meeting. The high prices had led countries such as Venezuela and Russia to raise barriers to the international oil companies, which have gone from control of 85 per cent of the world's oil reserves in 1970 to less than 10 per cent now. With prices on the rise, these countries did not feel they had to be as careful with their resources; some began managing their own oil and gas and failed to reinvest adequate profits to maintain production. Indeed, in 2007, Venezuela nationalized the energy sector and expropriated the assets of ExxonMobil and ConocoPhillips, which disagreed with the new terms offered. But oil prices have dropped from $147 a barrel last year to $48 a barrel, and US natural gas prices have fallen from more than $13 per million British thermal units to below $4. The oil-rich nations now require the expertise of the international oil companies to get costs down and grow production to maintain their economies. "This is a time they need companies like ours more than ever,' Mr. O'Reilly said. "That threat [to further nationalize] has receded quite a bit.' Rex Tillerson, Exxon's chief executive, agreed, noting Exxon had been around for more than 100 years and had vast experience with the rise and fall in commodity prices. The jury was still out, he said, on how the Russians would handle it: "They did not see this coming; they are dealing with it in real time.' He said Exxon was still embroiled in arbitration negotiations with Venezuela over the expropriation of its assets there. However, he said the delays on the Sakhalin 1 project were not due to the crisis but rather to changes on the Russian side of the board regulating the project, which meant new people did not understand the project and, therefore, did not approve processes as quickly. Mr. O'Reilly said Chevron was in a strong position, never having been "caught up in $140 oil'. It had a long queue of future projects and did not need to find opportunities in the downturn, although it would keep its eyes open. "We have a tremendous suite of opportunities and are not dependent on these opportunities to grow our portfolios,' Mr. O'Reilly said. Chevron would focus on reducing the cost of doing business, which had grown inflated with the rise in prices. It recognized it must not press vendors too hard, however, so they were healthy enough to help Chevron when demand rebounded.

03-12-2009 - The Financial Times by Sheila McNulty – Dave O'Reilly, chief executive of Chevron, said the oil-rich countries that erected barriers to international oil companies amid the run-up in commodity prices were now seeking their expertise in managing the drastic fall. "They're back now looking for [our] investment,' Mr. O'Reilly told Chevron's annual analysts' meeting. The high prices had led countries such as Venezuela and Russia to raise barriers to the international oil companies, which have gone from control of 85 per cent of the world's oil reserves in 1970 to less than 10 per cent now. With prices on the rise, these countries did not feel they had to be as careful with their resources; some began managing their own oil and gas and failed to reinvest adequate profits to maintain production. Indeed, in 2007, Venezuela nationalized the energy sector and expropriated the assets of ExxonMobil and ConocoPhillips, which disagreed with the new terms offered. But oil prices have dropped from $147 a barrel last year to $48 a barrel, and US natural gas prices have fallen from more than $13 per million British thermal units to below $4. The oil-rich nations now require the expertise of the international oil companies to get costs down and grow production to maintain their economies. "This is a time they need companies like ours more than ever,' Mr. O'Reilly said. "That threat [to further nationalize] has receded quite a bit.' Rex Tillerson, Exxon's chief executive, agreed, noting Exxon had been around for more than 100 years and had vast experience with the rise and fall in commodity prices. The jury was still out, he said, on how the Russians would handle it: "They did not see this coming; they are dealing with it in real time.' He said Exxon was still embroiled in arbitration negotiations with Venezuela over the expropriation of its assets there. However, he said the delays on the Sakhalin 1 project were not due to the crisis but rather to changes on the Russian side of the board regulating the project, which meant new people did not understand the project and, therefore, did not approve processes as quickly. Mr. O'Reilly said Chevron was in a strong position, never having been "caught up in $140 oil'. It had a long queue of future projects and did not need to find opportunities in the downturn, although it would keep its eyes open. "We have a tremendous suite of opportunities and are not dependent on these opportunities to grow our portfolios,' Mr. O'Reilly said. Chevron would focus on reducing the cost of doing business, which had grown inflated with the rise in prices. It recognized it must not press vendors too hard, however, so they were healthy enough to help Chevron when demand rebounded.  Qatar Bundles Fields to Lure Explorers

Qatar Bundles Fields to Lure Explorers

03-12-2009 -Bloomberg by Dinakar Sethuraman - Qatar, the world’s biggest producer of liquefied natural gas, may combine two gas areas into a single block to draw foreign explorers, the International Oil Daily said without citing anybody. Explorers didn’t show interest in Qatar’s offer of a deep water gas area called Block A last year, prompting Qatar Petroleum to merge Block B and Block C, the report said. The areas lie near shallow water fields Bul Hanine and Maydan Mazhan. Companies interested in Qatar including Total SA, AP Moeller Maersk A/S, Wintershall AG, Eni SpA and GDF Suez SA didn’t bid for Block A, the energy news daily said. The companies found investing risky because Qatar offered a low price for the gas discovered and there were fewer possibilities for finding associated liquids, sales of which typically enable gas explorers to make profits, the newsletter said. Bids for Block B and Block C are due by April 20 and Block A may be awarded within weeks, the report said. The country has stopped awarding new areas in the North Field, part of the world’s biggest gas area it shares with Iran, to assess reserves by 2012. The new deep water areas are outside the North Field.

03-12-2009 -Bloomberg by Dinakar Sethuraman - Qatar, the world’s biggest producer of liquefied natural gas, may combine two gas areas into a single block to draw foreign explorers, the International Oil Daily said without citing anybody. Explorers didn’t show interest in Qatar’s offer of a deep water gas area called Block A last year, prompting Qatar Petroleum to merge Block B and Block C, the report said. The areas lie near shallow water fields Bul Hanine and Maydan Mazhan. Companies interested in Qatar including Total SA, AP Moeller Maersk A/S, Wintershall AG, Eni SpA and GDF Suez SA didn’t bid for Block A, the energy news daily said. The companies found investing risky because Qatar offered a low price for the gas discovered and there were fewer possibilities for finding associated liquids, sales of which typically enable gas explorers to make profits, the newsletter said. Bids for Block B and Block C are due by April 20 and Block A may be awarded within weeks, the report said. The country has stopped awarding new areas in the North Field, part of the world’s biggest gas area it shares with Iran, to assess reserves by 2012. The new deep water areas are outside the North Field.

Saudis - Enforce Existing Supply Curbs

Saudis - Enforce Existing Supply Curbs

03-10-2009 - (Arabian Business News) - Saudi Arabia wants OPEC to discuss stricter compliance with existing supply curbs and not debate another production cut, a Saudi-owned newspaper reported on Monday, citing sources. OPEC ministers meet to discuss oil supply policy on Sunday in Vienna. The group has agreed to cut 4.2 million barrels per day - around five percent of global supply - since September to shore up prices. "There is no need to speak of a new production cut as it would be enough to enhance compliance with the previous decisions," daily newpaper al-Hayat reported, citing unnamed sources. "Saudi has informed the presidency of the organisation, which is Angola, that there must be... serious compliance with the latest reduction decision taken in December, which has prevented oil prices from falling further," the newspaper reported, citing a senior source.

03-10-2009 - (Arabian Business News) - Saudi Arabia wants OPEC to discuss stricter compliance with existing supply curbs and not debate another production cut, a Saudi-owned newspaper reported on Monday, citing sources. OPEC ministers meet to discuss oil supply policy on Sunday in Vienna. The group has agreed to cut 4.2 million barrels per day - around five percent of global supply - since September to shore up prices. "There is no need to speak of a new production cut as it would be enough to enhance compliance with the previous decisions," daily newpaper al-Hayat reported, citing unnamed sources. "Saudi has informed the presidency of the organisation, which is Angola, that there must be... serious compliance with the latest reduction decision taken in December, which has prevented oil prices from falling further," the newspaper reported, citing a senior source.

PetroChina to Buy Exxon Mobil LNG

PetroChina to Buy Exxon Mobil LNG

03-05-2009 - Bloomberg by Wang Ying - PetroChina Co., the country’s biggest oil producer, may sign an accord with Exxon Mobil Corp. in the first half of this year to buy liquefied natural gas from the Gorgon project in Australia under a term contract. “We are in discussions,” PetroChina Chairman Jiang Jiemin said in an interview in Beijing today. “There should be no problem in signing it in the first half.” Chevron Corp. has a 50 percent stake in the Western Australian project, while Exxon and Royal Dutch Shell Plc each have 25 percent. PetroChina is signing LNG supply accords as terminals to receive cargoes of the fuel are built on the country’s eastern coast. The government plans to double the use of cleaner-burning fuels by 2010 to cut reliance on coal and oil. The agreement is unlikely to be signed this month, Jiang said today. Exxon, the world’s largest oil company, agreed to sell 2 million metric tons of LNG a year from the Gorgon project to the Beijing-based company under a term contract, two PetroChina officials and one official from an Asian unit of Gorgon operator Chevron said on Feb. 24. The purchase will be in addition to the 2 million-ton-a- year accord signed in 2008 between Shell and PetroChina. Under the agreement with Shell, the LNG will come from the Gorgon project and Shell’s global portfolio, said the China unit of Europe’s largest oil company in November. In an initial accord signed in September 2007, PetroChina agreed to buy 1 million tons from Shell.

03-05-2009 - Bloomberg by Wang Ying - PetroChina Co., the country’s biggest oil producer, may sign an accord with Exxon Mobil Corp. in the first half of this year to buy liquefied natural gas from the Gorgon project in Australia under a term contract. “We are in discussions,” PetroChina Chairman Jiang Jiemin said in an interview in Beijing today. “There should be no problem in signing it in the first half.” Chevron Corp. has a 50 percent stake in the Western Australian project, while Exxon and Royal Dutch Shell Plc each have 25 percent. PetroChina is signing LNG supply accords as terminals to receive cargoes of the fuel are built on the country’s eastern coast. The government plans to double the use of cleaner-burning fuels by 2010 to cut reliance on coal and oil. The agreement is unlikely to be signed this month, Jiang said today. Exxon, the world’s largest oil company, agreed to sell 2 million metric tons of LNG a year from the Gorgon project to the Beijing-based company under a term contract, two PetroChina officials and one official from an Asian unit of Gorgon operator Chevron said on Feb. 24. The purchase will be in addition to the 2 million-ton-a- year accord signed in 2008 between Shell and PetroChina. Under the agreement with Shell, the LNG will come from the Gorgon project and Shell’s global portfolio, said the China unit of Europe’s largest oil company in November. In an initial accord signed in September 2007, PetroChina agreed to buy 1 million tons from Shell.

Norway Reviews Arctic Fields for Exp. & Prod.

Norway Reviews Arctic Fields for Exp. & Prod.

03-04-2009 - (Reuters) - The Norwegian industry has listed three areas off the scenic Lofoten and Vesteraalen islands as the most interesting oil and gas exploration areas off Norway's Arctic coast in a new report to the government. The oil industry has long hungered for the areas of Nordland VI, Nordland VII and Troms II, and the Norwegian Oil Industry Federation (OLF) and its partners in the KonKraft group said opening them to drilling could contribute significantly to slowing a long-term decline in Norwegian petroleum production. Nordland VII and Troms II have never been open to petroleum activity. Parts of Nordland VI have earlier been explored, but the area is now out of bounds to drilling under a 2006 government management plan for the Barents Sea and Lofoten. The Labour-led government says it will not decide whether to open the areas until 2010, after September 2009 elections. The Socialist Left Party, a junior partner in the government, is bitterly opposed to opening more of the Arctic to drilling. Environmental protection campaigners say the Arctic areas should stay off limits and are vulnerable to oil spills because of rich fish stocks and bird populations. "Forecasts indicate that Norwegian petroleum production will fall markedly over the next decade," OLF chief Per Terje Vold said in a statement with the new report entitled "Oil Activity in the North." Non-OPEC Norway is the world's fourth biggest oil exporter and Western Europe's biggest gas producer. "Access to new and attractive exploration acreage would slow this decline, sustain government revenues to the benefit of the community, keep 250,000 people in work and open opportunities for 1,000-2,000 new jobs," Vold said. KonKraft -- linking the OLF, the Federation of Norwegian Industries, the Norwegian Association of Shipowners and Trade Union Federation LO -- has earlier estimated that Nordland VI, VII and Troms II may contain 3.4 billion barrels of oil equivalent (boe). That would be about five times the size of a field like Norne in the Norwegian Sea. In 2003, the Norwegian Petroleum Directorate (NPD) estimated the areas' resources at around 1.5 billion boe, but in more recent resources reports the NPD has not given estimates for Nordland VI, Nordland VII and Troms II due to uncertainties. "StatoilHydro has in various fora given an estimate for this area of 2 billion barrels of oil equivalents," the new KonKraft report said. The KonKraft group said its resource figure was based on average estimates obtained in interviews "with a number of companies that are assumed to have reasonably good knowledge of the Norwegian shelf." The group said its estimate of the economic spinoff effects of developing the offshore areas, including its job estimates, was based on fields with just over 2 billion boe of resources.

03-04-2009 - (Reuters) - The Norwegian industry has listed three areas off the scenic Lofoten and Vesteraalen islands as the most interesting oil and gas exploration areas off Norway's Arctic coast in a new report to the government. The oil industry has long hungered for the areas of Nordland VI, Nordland VII and Troms II, and the Norwegian Oil Industry Federation (OLF) and its partners in the KonKraft group said opening them to drilling could contribute significantly to slowing a long-term decline in Norwegian petroleum production. Nordland VII and Troms II have never been open to petroleum activity. Parts of Nordland VI have earlier been explored, but the area is now out of bounds to drilling under a 2006 government management plan for the Barents Sea and Lofoten. The Labour-led government says it will not decide whether to open the areas until 2010, after September 2009 elections. The Socialist Left Party, a junior partner in the government, is bitterly opposed to opening more of the Arctic to drilling. Environmental protection campaigners say the Arctic areas should stay off limits and are vulnerable to oil spills because of rich fish stocks and bird populations. "Forecasts indicate that Norwegian petroleum production will fall markedly over the next decade," OLF chief Per Terje Vold said in a statement with the new report entitled "Oil Activity in the North." Non-OPEC Norway is the world's fourth biggest oil exporter and Western Europe's biggest gas producer. "Access to new and attractive exploration acreage would slow this decline, sustain government revenues to the benefit of the community, keep 250,000 people in work and open opportunities for 1,000-2,000 new jobs," Vold said. KonKraft -- linking the OLF, the Federation of Norwegian Industries, the Norwegian Association of Shipowners and Trade Union Federation LO -- has earlier estimated that Nordland VI, VII and Troms II may contain 3.4 billion barrels of oil equivalent (boe). That would be about five times the size of a field like Norne in the Norwegian Sea. In 2003, the Norwegian Petroleum Directorate (NPD) estimated the areas' resources at around 1.5 billion boe, but in more recent resources reports the NPD has not given estimates for Nordland VI, Nordland VII and Troms II due to uncertainties. "StatoilHydro has in various fora given an estimate for this area of 2 billion barrels of oil equivalents," the new KonKraft report said. The KonKraft group said its resource figure was based on average estimates obtained in interviews "with a number of companies that are assumed to have reasonably good knowledge of the Norwegian shelf." The group said its estimate of the economic spinoff effects of developing the offshore areas, including its job estimates, was based on fields with just over 2 billion boe of resources.

Sakhalin Energy Inks New Deal with Osaka Gas

Sakhalin Energy Inks New Deal with Osaka Gas

03-04-2009 -(RBC News) - Sakhalin Energy, a consortium operating the Sakhalin-2 oil and gas project, and Japan's second largest natural gas company Osaka Gas signed another liquefied natural gas (LNG) sale and purchase agreement today. As reported by the consortium's press office, some 200,000 tons of LNG per year will be supplied within a 20-year period under the new deal. As announced earlier, an LNG sale and purchase agreement was already signed with Osaka Gas in 2007. This will be the last agreement on LNG sales signed by Sakhalin Energy as part of its marketing campaign for the output of its two LNG processing lines estimated at 9.6m tons of LNG per year. All of the future LNG output has been contracted for over 20 years to come. Around two thirds of the total production will be shipped to nine customers in Japan, the world's largest LNG consumer. The remainder will be supplied to South Korea and North America.

03-04-2009 -(RBC News) - Sakhalin Energy, a consortium operating the Sakhalin-2 oil and gas project, and Japan's second largest natural gas company Osaka Gas signed another liquefied natural gas (LNG) sale and purchase agreement today. As reported by the consortium's press office, some 200,000 tons of LNG per year will be supplied within a 20-year period under the new deal. As announced earlier, an LNG sale and purchase agreement was already signed with Osaka Gas in 2007. This will be the last agreement on LNG sales signed by Sakhalin Energy as part of its marketing campaign for the output of its two LNG processing lines estimated at 9.6m tons of LNG per year. All of the future LNG output has been contracted for over 20 years to come. Around two thirds of the total production will be shipped to nine customers in Japan, the world's largest LNG consumer. The remainder will be supplied to South Korea and North America.  Avenue pools Israeli licences

Avenue pools Israeli licences

03-03-2009 - Upstream OnLine - Avenue Energy Israel has agreed to pool its licences in the Heletz Field in southern Israel with Lapidoth-Heletz. Under the agreement, Avenue will contribute its 100% interest in the Heletz-Kokhav licence and its 50% interest in the Iris license and Lapidoth-Heletz will contribute its 50% interest in the Iris License into a pooling arrangement whereby Avenue will retain a 75% interest and Lapidoth a 25% interest in the combined licenses. Avenue will operate the field ``The pooling agreement is a win-win situation for AEI and L-H because it affords us the ability to focus on the optimal technical approach for the exploitation and development of the Heletz field,' Avenue head Levi Mochkin said. The Heletz field, discovered in 1955, is Israel's only producing oilfield.

03-03-2009 - Upstream OnLine - Avenue Energy Israel has agreed to pool its licences in the Heletz Field in southern Israel with Lapidoth-Heletz. Under the agreement, Avenue will contribute its 100% interest in the Heletz-Kokhav licence and its 50% interest in the Iris license and Lapidoth-Heletz will contribute its 50% interest in the Iris License into a pooling arrangement whereby Avenue will retain a 75% interest and Lapidoth a 25% interest in the combined licenses. Avenue will operate the field ``The pooling agreement is a win-win situation for AEI and L-H because it affords us the ability to focus on the optimal technical approach for the exploitation and development of the Heletz field,' Avenue head Levi Mochkin said. The Heletz field, discovered in 1955, is Israel's only producing oilfield.

Monday, March 02, 2009

Tethys Petroleum Signs Uzbekistan Oil Production Project Agreement

Tethys Petroleum Signs Uzbekistan Oil Production Project Agreement

BP Exits Indonesian Field

BP Exits Indonesian Field

02.03.2009 - Reuters-Neftegaz.RU - The Offshore North West Java (ONWJ) block produces 24,000 barrels of oil per day (bpd) and around 220 billion British thermal unit of gas a day, according to an industry source. "BP plans to complete the divestment by the end of 2009. ONWJ PSC (production sharing contract) has been an important part of our portfolio for many years. However, it does not fit with the company's long term strategy," BP said in its statement. The firm declined to give a selling price, saying the information was commercially confidential. But it said the sale would not affect BP's other interests in Indonesia, which include the $5 billion Tangguh liquefied natural gas project in Papua. Other major shareholders in ONWJ include China's CNOOC with 36.72 percent and Japan's Inpex with 7.25 percent, BP said. The Tangguh project is scheduled to see first commercial shipments of LNG in the second quarter of 2009, the company said.

02.03.2009 - Reuters-Neftegaz.RU - The Offshore North West Java (ONWJ) block produces 24,000 barrels of oil per day (bpd) and around 220 billion British thermal unit of gas a day, according to an industry source. "BP plans to complete the divestment by the end of 2009. ONWJ PSC (production sharing contract) has been an important part of our portfolio for many years. However, it does not fit with the company's long term strategy," BP said in its statement. The firm declined to give a selling price, saying the information was commercially confidential. But it said the sale would not affect BP's other interests in Indonesia, which include the $5 billion Tangguh liquefied natural gas project in Papua. Other major shareholders in ONWJ include China's CNOOC with 36.72 percent and Japan's Inpex with 7.25 percent, BP said. The Tangguh project is scheduled to see first commercial shipments of LNG in the second quarter of 2009, the company said.  Total in No. 2 Azeri pact with SOCAR

Total in No. 2 Azeri pact with SOCAR

02-27-2009 - Scandinavian Oil & Gas - Total announces today that it has signed an agreement with Azerbaijan’s state-owned SOCAR. The exploration, development and production sharing agreement (EDPSA) covers a license on the Absheron offshore block. This block is located in the Caspian Sea, 100 kilometers from Baku, in a water depth of around 500 meters. Total will be the operator of the Absheron Block during the exploration phase. For the development phase, Total and SOCAR will jointly form an operating company for the management of operations. Total will hold a 60% interest and SOCAR will hold a 40% interest. “Total is pleased to continue developing its presence in the Republic of Azerbaijan and to extend in the Caspian Sea. This agreement enters into the framework of the group’s global exploration strategy” said Yves-Louis Darricarrère, President Exploration and Production. This latest exploration contract will strengthen Total’s ties with the Republic of Azerbaijan. The company will continue to support the development of Azerbaijan’s oil and gas industry over the long term. Total also has a 10% stake in South Caucasus Pipeline Company (SCPC), which owns the pipeline that carries Shah Deniz gas to Turkey and Georgia. In addition, the Group has a 5% interest in the Baku-Tblisi-Ceyhan (BTC) oil pipeline from Baku to the Mediterranean Sea. In 2007, the pipeline was used in particular to export condensate from Shah Deniz. The Group also directly participates in health, education and solidarity programs that are in line with its policies of sustainable development and investment in local communities.

02-27-2009 - Scandinavian Oil & Gas - Total announces today that it has signed an agreement with Azerbaijan’s state-owned SOCAR. The exploration, development and production sharing agreement (EDPSA) covers a license on the Absheron offshore block. This block is located in the Caspian Sea, 100 kilometers from Baku, in a water depth of around 500 meters. Total will be the operator of the Absheron Block during the exploration phase. For the development phase, Total and SOCAR will jointly form an operating company for the management of operations. Total will hold a 60% interest and SOCAR will hold a 40% interest. “Total is pleased to continue developing its presence in the Republic of Azerbaijan and to extend in the Caspian Sea. This agreement enters into the framework of the group’s global exploration strategy” said Yves-Louis Darricarrère, President Exploration and Production. This latest exploration contract will strengthen Total’s ties with the Republic of Azerbaijan. The company will continue to support the development of Azerbaijan’s oil and gas industry over the long term. Total also has a 10% stake in South Caucasus Pipeline Company (SCPC), which owns the pipeline that carries Shah Deniz gas to Turkey and Georgia. In addition, the Group has a 5% interest in the Baku-Tblisi-Ceyhan (BTC) oil pipeline from Baku to the Mediterranean Sea. In 2007, the pipeline was used in particular to export condensate from Shah Deniz. The Group also directly participates in health, education and solidarity programs that are in line with its policies of sustainable development and investment in local communities.

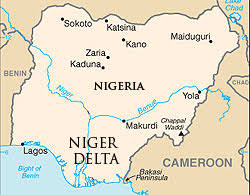

Chevron Confirms Commitment to Develop Niger Delta

Chevron Confirms Commitment to Develop Niger Delta

25.02.2009 - [Neftegaz.RU] - Fawthrop stated this in Abuja when he visited Nigeria's Minister of Niger Delta Affairs Obong Ufot Ekaette, adding that the company's activities had spanned a period of 50 years, manifesting in commercial oil exploration and community development successes. He said Chevron better understands the terrain of the region with 50 years of its existence and knows where its services are needed. "We cannot do this outside now that there is a ministry on ground and thus the essence of this visit, so that we can rub minds to partner in this vein," he added. In his response, the minister said some host communities had complained of the ill treatment by some oil companies that had kept the region at the present state. He said although the government had recognized some good works done by some oil companies, they still needed to intensify their efforts. He explained that the struggle for development of the region has been on and several attempts by oil companies to tackle the problems have yielded little or no results. "The ministry will continue to interface with stakeholders, so that there would be synergy in order to avoid duplications of efforts and waste of resources," the minister said. Ekaette noted that it would be better to understand the causes of militancy in a bid to achieve the desired results. The Niger Delta is an unstable area of Nigeria ,and inter ethnic clashes are common practice, often access to oil revenue is the trigger for the violence.

25.02.2009 - [Neftegaz.RU] - Fawthrop stated this in Abuja when he visited Nigeria's Minister of Niger Delta Affairs Obong Ufot Ekaette, adding that the company's activities had spanned a period of 50 years, manifesting in commercial oil exploration and community development successes. He said Chevron better understands the terrain of the region with 50 years of its existence and knows where its services are needed. "We cannot do this outside now that there is a ministry on ground and thus the essence of this visit, so that we can rub minds to partner in this vein," he added. In his response, the minister said some host communities had complained of the ill treatment by some oil companies that had kept the region at the present state. He said although the government had recognized some good works done by some oil companies, they still needed to intensify their efforts. He explained that the struggle for development of the region has been on and several attempts by oil companies to tackle the problems have yielded little or no results. "The ministry will continue to interface with stakeholders, so that there would be synergy in order to avoid duplications of efforts and waste of resources," the minister said. Ekaette noted that it would be better to understand the causes of militancy in a bid to achieve the desired results. The Niger Delta is an unstable area of Nigeria ,and inter ethnic clashes are common practice, often access to oil revenue is the trigger for the violence.

Contact me: